Share this article:

In our latest guest blog, our corporate partners, Invennt, discuss R&D tax credits, and how to claim for same.

Why is the construction sector missing out on R&D tax credits?

Despite construction being fertile ground for the type of innovative problem solving that qualifies for R&D tax credits, the industry in Ireland routinely overlooks the incentive, costing businesses millions in unclaimed tax relief each year. CIF Corporate Partner, Invennt explains the reasons for this and what companies can do about it.

What are R&D tax credits?

The R&D tax credit scheme was introduced by the Irish government in 2004 to incentivise investment in innovation by deducting up to 25% of the companies spend on overcoming technical uncertainty from their corporation tax liability. The credit can be used to reduce current or future tax liabilities, and in some cases, companies can choose to have the credit refunded as a cash payment.

Why isn’t the industry claiming its fair share?

Most countries administer a similar scheme, but because they are available to all sectors, the language used to describe them is frequently biased towards the product-based industries that make up the lion’s share of economic activity, such as manufacturing, software and pharmaceuticals. This usually means that governments use some variation of the term “R&D” as a name for the scheme, but when you dig deeper into the detail of the tax code it soon becomes apparent that much of the activity undertaken by construction also qualifies.

This has led to slow adoption by construction relative to other industries, but elsewhere this trend has reversed more recently. For example, across the Irish Sea, claims by UK domiciled construction firms have risen rapidly, approaching a level where they are broadly in line with other sectors of the economy, and this trend is being repeated in the USA and Canada. Awareness of the scheme in Ireland is also increasing fast, which is why it’s important to act now to prevent falling behind competitors.

What qualifies?

It is important to remember that R&D doesn’t just happen in a lab – quite often it’s part of the day-to-day activity of delivering a construction project. This could be overcoming constrained sites and unfavourable ground conditions, or it could be developing solutions to improve health and safety and environmental performance. Given the complex and unpredictable environment in which construction operates, the list of qualifying activity is virtually limitless.

Eligible expenditure includes direct expenses such as payroll, material, subcontract costs, as well as certain overheads. Furthermore, the qualifying activity doesn’t need to be undertaken in Ireland, with any activity performed in the European Economic Area (EEA) or the UK also eligible for inclusion.

How to claim?

A claim must be made within 12 months from the end of the accounting period that the R&D expenditure was incurred in. Claims must be supported by documentary evidence to demonstrate entitlement and a financial analysis that shows how costs have been apportioned. Due to the complexity of the tax code and the difficulty reconciling the language used with the terminology used in construction, it makes sense to appoint an advisor to avoid overstating a claim and falling foul of an audit by the Revenue or understating a claim and missing out on relief owed to the business.

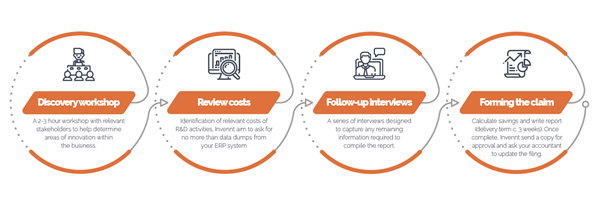

Invennt have a simple 4-stage discovery process to identify qualifying activity and apportion costs:

<Click here to book a free exploratory call>

FAQs

Click here for the most common FAQs on R&D tax credits.

About Invennt

Invennt is a specialist business consultancy for construction. The firm only employ consultants who are chartered with relevant professional bodies in the industry (e.g. CIOB, ICE, IStructE APM, RICS), making the claims process as easy and robust as possible. Furthermore, because the business files claims in multiple tax jurisdictions it can transfer knowledge and experience from each of the countries it operates in, leading to well-evidenced claims that deliver maximum financial reward for the claimant. Finally, the business does more than just tax, meaning their discovery process is informed and enhanced by expertise in strategic and operational consulting.